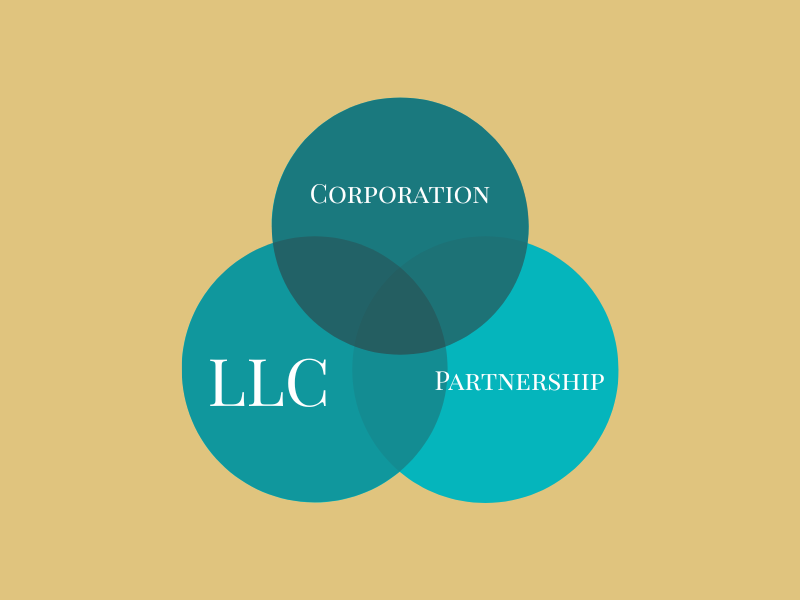

LLC vs Partnership vs Corporation in California

Learn how to claim a deceased person’s bank accounts with ease. Understand bank account beneficiary rules and follow our guide to secure your rightful funds.

What Is a Testamentary Trust?

Learn how to claim a deceased person’s bank accounts with ease. Understand bank account beneficiary rules and follow our guide to secure your rightful funds.

How to Claim a Deceased Person’s Bank Accounts

Learn how to claim a deceased person’s bank accounts with ease. Understand bank account beneficiary rules and follow our guide to secure your rightful funds.

Who Can Override a Power of Attorney?

Learn how to override a power of attorney, revoke misuse, and protect loved ones. Find out who can intervene and when legal action is necessary.

How to Protect Your Business from Unfair Practices in California

Learn how to protect your business from unfair practices in California. Discover strategies to safeguard your business from deceptive business practices.

Are Trust Distributions Taxable?

Find out if trust distributions are taxable and learn how they operate. Protect your estate. Speak with our attorneys for clear guidance.

Transferring a Mortgage to Another Person

Learn how to transfer a mortgage or property title in California. Take a look at the steps, legal tips, and how Stone & Sallus can assist you.

Grounds for Suing a Business Partner

Discover the common grounds for suing a business partner, including breach of contract, fiduciary duty, fraud, and more. Protect your business interests.

How to Find Out if Someone Has a Will

Learn how to find out if someone has a will with steps for checking public records, online databases, attorneys, and probate courts.

Can You Contest a Will in California?

Learn how to contest a will in California, including timelines, legal grounds, and steps. Get expert guidance from Stone & Sallus attorneys.

Real Property vs Personal Property in California

Learn the key differences between real and personal property in California and how Stone & Sallus can help with matters of Real Property vs. Personal Property.

How To Form a Business Partnership in California

Learn how to form a business partnership in California with essential steps for legal compliance, taxes, and agreements to protect your business.

Inherited Property with Multiple Owners

Explore the legal process of selling inherited property with multiple owners, solutions for disputes, and how to divide assets between siblings in California.

The Pros and Cons of Business Partnerships

Learn about the pros and cons of business partnerships in California, including legal considerations, tax benefits, and risks. Get expert guidance with Stone & Sallus.

Do You Pay Inheritance Tax On a Trust in California?

Learn if you pay inheritance tax on a trust in California. Understand tax implications, beneficiary obligations, and how to protect your inheritance with Stone & Sallus.

How to Dissolve a Partnership in California

Learn how to dissolve a partnership in California, covering legal steps, reasons, challenges, and how Stone & Sallus can help you end the business partnership.